Attain Financial Freedom By Learning to Budget : Part 2 How to Budget

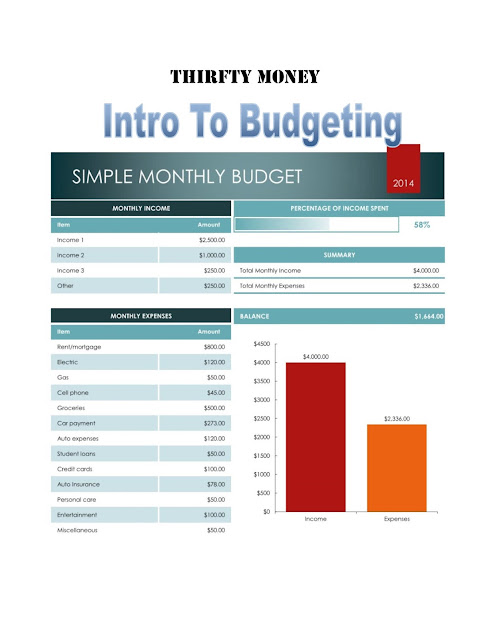

Now that we've covered the why of budgeting, let's hit the how. To start, grab yourself a pen and paper or an excel sheet or pull up the app/website of your choice. While it can seem more concrete if you write it all down, I find tracking to be much simpler if I use excel or an online application. The photo in the title is an excel spreadsheet. There a tons of different options in excel if you search for budget when you go to open a new workbook. If none of them fit your style, feel free to create your own.

I personally use a combination of Every Dollar for tracking expenses and an excel spreadsheet to create the initial budget and track annual expenses. Yes, I create an annual budget in addition to the monthly budget. This allows me to maximize savings, predict future habits (such as saving) and best estimate our mortgage payoff date or our financial independence date. Don't worry, you can choose just one budget tool and focus on monthly expenses. Then if you get bored with that, expand your budgeting expertise.

Every Dollar's site allows you to track purchases from your computer or from your iphone. For a fee it will automatically pull transaction that you make with a card into your tracking. It lets you create funds so you can use it similar to an envelope system and roll your unspent money into the next month. That helps with savings goals too.

Mobile Version Every Dollar

Website Version Every Dollar

There are many other sites that do similar tasks such as mint.com. The government has even published a site to help you create your budget, though you aren't able to track your purchases on this one.

Now that you've pick your poison for drawing up your budget, let's begin. Start by adding up your income. Include all earnings contributing to your monthly expenses (second jobs, expected tax returns, retirement income, social security, etc.) Then we can move on to your expenses. Here is where you will need to personalize your budget to fit your lifestyle. Add or remove categories as necessary. The list below is not all-inclusive:

- Living Expenses

- Rent/Mortgage

- Utilities

- Electricity

- Water

- Gas

- Phone

- Internet

- Cable/Netflix

- Other

- Food

- Groceries

- Restaurants

- Transportation

- Gas

- Repairs

- Taxes & Licensure

- Medical

- Medication

- Bills

- Vitamins

- Additional Expenses

- Clothing

- Personal Spending

- Cosmetics/Haircare

- Toiletries

- Gifts

- Pocket Money

- Entertainment

- Charity

- Savings

- Retirement

- Emergency Fund

- Other Savings

- Home

- Cleaning Supplies

- Home Improvement

- Furniture

- Other

Once again this list is not all encompassing and you should add or remove categories as necessary. Just make sure you are putting money towards the necessities (rent, food, lights, etc.) before allotting money to entertainment or eating out. Your goal is to get expenses to equal your income. This means you know where every penny of your earnings is going and won't be surprised at the end of the month hopefully. Once you have all of your categories listed and have assigned an amount to each one, go through and add your income and expenses separately. Ideally, these will equal one another. Below is an explanation of what it means if they do not equal.

EXPENSE > INCOME = DEFICIT (DEBT)

EXPENSE < INCOME = SURPLUS (EXTRA SAVINGS)

EXPENSE = INCOME = BALANCED BUDGET!!! (IDEAL)

If you are experiencing a deficit, you will need to revisit the non-necessity items in your list. Maybe that will require you to reduce your eating out budget or put off home improvement until later. This might also show you that you need to work on getting your income up to live the life you want. A second job can help temporarily, but in the long run you will want to look for a career choice that pays the wages you need to live or adjust your lifestyle to your current salary.

A budget should be completed monthly. You can always sit down and adjust your monthly plan as necessary. For example, if you work a fair amount of overtime, you will end up with more money. Pick a place to spend this money so you don't waste your hard work on something you won't remember. By creating this plan and tracking your spending throughout the month you can accomplish great things.

Comments

Post a Comment