2019 New Year's Goals

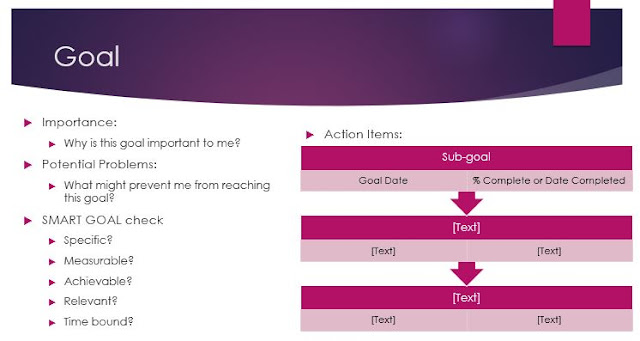

While it is rather late in January to be posting about goals or resolutions, we figure better late than never. We have revamped our goal tracking and presentation for 2019 for better visual tracking and hopefully will lead to better goal progress. We have created visuals for each goal that discuss the goal, the importance of each goal, potential problems, and a tracking graphic to show our progress. Most of the goals we have broken down into sub-goals (such as monthly or weekly) to track and force us to check in more regularly. It also will cause us to re-evaluate throughout the year if we begin falling behind. The SMART goal check is listed on the first graphic as a reminder of how to set goals, but is not broken down on subsequent goals. Example of Goal Tracking Graphics We post monthly updates to hold ourselves accountable and allow others to follow along with us. Let us know your goals too - comment on the post, message us on Facebook, or send an email! If you'd like to