Thriftism's Monthly Budget

We have been talking budgets quite a bit lately. The start of a new year brings a bigger budget meeting at our household and since keeping the budget and high levels of savings are on our goals this year, the budget is especially important. This allows us to know where we have available money to spend (for trips, entertainment, house projects, etc.) and helps us track where our money is going. Overall, the budget helps us focus on the things that are important to us - travel, financial security, hobbies - and keep us from spending too much money on items that aren't important to us - eating out, general "stuff". By seeing what we can do with our money, it prevents us from wanting to keep up with the Jones' since we see a better future ahead.

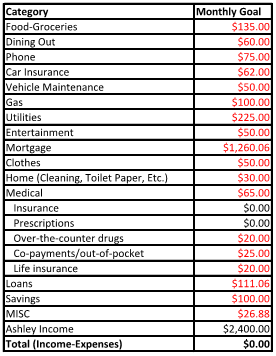

Some of our videos mention numbers and many times people do not believe the dollar amount we are throwing out there. For this reason, we decided to start sharing our monthly budgets with you. We will post updates and show that it is in fact possible to live and save on a low income. While this budget doesn't include all of our savings or fun expenditures (which tend to come from the second income), it does show how to live without taking on debt and how it is possible to save even on a low income. With that, here is our first budget of the year. We will post monthly with our budget updates.

We run our budget off of solely my income of $1200 every two weeks, however this is after insurance is taken out. If this was your total household income, you would gross around $34,000/year and be in the 15% tax bracket. If you were in this tax bracket as a married couple, you would likely qualify for free or nearly free insurance so we won't need to up our budget in that area at this point. As employment changes, we will adjust our insurance costs as necessary. This budget also does not include much of our discretionary spending such as travel and home renovations, but it is our essentials budget that we could live on without anything else.

Some of our videos mention numbers and many times people do not believe the dollar amount we are throwing out there. For this reason, we decided to start sharing our monthly budgets with you. We will post updates and show that it is in fact possible to live and save on a low income. While this budget doesn't include all of our savings or fun expenditures (which tend to come from the second income), it does show how to live without taking on debt and how it is possible to save even on a low income. With that, here is our first budget of the year. We will post monthly with our budget updates.

We run our budget off of solely my income of $1200 every two weeks, however this is after insurance is taken out. If this was your total household income, you would gross around $34,000/year and be in the 15% tax bracket. If you were in this tax bracket as a married couple, you would likely qualify for free or nearly free insurance so we won't need to up our budget in that area at this point. As employment changes, we will adjust our insurance costs as necessary. This budget also does not include much of our discretionary spending such as travel and home renovations, but it is our essentials budget that we could live on without anything else.

The Budget

As you can see from the table above, our goal budget is balanced with total income minus expenses equal to zero. Number in red are spending, while black is income. As with most budgets, I would recommend simply tracking your spending and income for one month before allocating money to ensure enough is budgeted for each item.

One major take away from our budget is that debt is killing the budget! $111.06 in student loans is a substantial payment out of our $2400 budget and we didn't even borrow that much money. If you have greater student loan payments, you will likely need an additional job or to search for a higher paying position. If you haven't taken out loans, my advice would be to work so hard you don't need loans. While the student loan seems like a lot, the mortgage is the real killer here. This is over half of our monthly budget. While this is technically affordable in our budget, I would recommend getting a mortgage that is around 25% or less of your take-home pay. This is a 15-year mortgage and we could save ~$350-$400/ month by refinancing to a 30-year, but that would not align with our financial security plan.

Last thoughts...

This is a crazy tight budget, but 100% doable! Making $2400/month still allows us to save $100 from my paycheck while still paying for everything necessary. Plus this allows us to use the second income as savings or discretionary spending. Stay tuned for our budget check-in early in February to see if we are staying on track.

Comments

Post a Comment