Thriftism's Monthly Budget - January Update - Sams Club Closure Killed the Budget

As we mentioned at the beginning of January, we are going to post monthly budget updates- So here we are! For a quick reminder, we run our budget off of solely my income of $1200 every two weeks, however this is after insurance is taken out. If this was your total household income, you would gross around $34,000/year and be in the 15% tax bracket. If you were in this tax bracket as a married couple, you would likely qualify for free or nearly free insurance so we won't need to up our budget in that area at this point. This budget also does not include much of our discretionary spending such as travel and home renovations, but it is our essentials budget that we could live on without anything else.

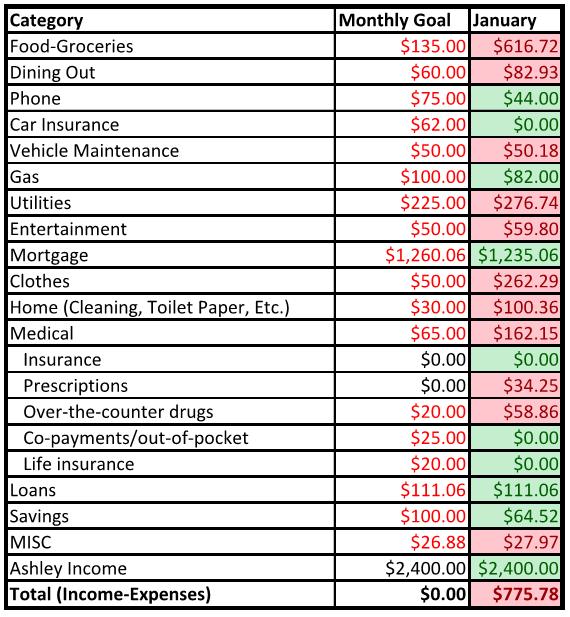

The Budget

As you can see from the table above, our goal budget is balanced with total income minus expenses equal to zero. Number in red are spending, while black is income.

WE FAILED?!?!?!

While the January number shows that we did terrible - not even close to an even budget - I wanted to give you the real numbers. Medical was more expensive since the flu passed through the household and Mucinex and Tamiflu were much desired. The utility bill was higher, but this typically balances out as we head into the summer months. Dining out was also high - we ate our to take advantage of my free birthday meals, but that meant Race had to buy dinner as well. We will reduce this in February.

The biggest overages were food, clothing, and home supplies. We spent around $850 at Sam's club during the store closing.

MORE LIKE A SUCCESS

Yes, that seems ridiculous, but with everything ranging between 25-50% off, we had to take advantage of the deal. This is the great part about living the way we do, we have the ability to take advantage of deals. If you are living paycheck to paycheck, you should not spend almost $1,000 buying food and clothing since it would likely go on a credit card. We have the money in savings/a second employment to cover these costs. We didn't buy anything fun - like a tv or computer - we bought a lot (A LOT) of dried and canned foods, clothing, and home supplies as well as things like oil for the car. When are you able to buy a can of tuna for $0.30? Never, at least not when it isn't expired or dented.

By spending extra in January, our food budget will be vastly reduced in coming months and we got bigger discounts than we'd ever get on things like beans and rice and protein powder. While this budget looks out of hand, it will begin to break even starting next month and will be great by the end of the year.

Last thoughts...

At first look, the budget appears to have fallen apart. Looking deeper you can see we made a strategic move by investing in food and clothing at a lower cost than we would otherwise be able to find. This required us to spend a large chunk of money upfront. Do NOT do this if you are in debt. You will lose money by paying interest. If you have the money available take advantage of the clearance sales by buying items you need (not want) and make an oath not to overspend in the coming months to make your purchase worthwhile. Come back in February to see if we follow through on lowering our spending. (I bet we will).

Comments

Post a Comment