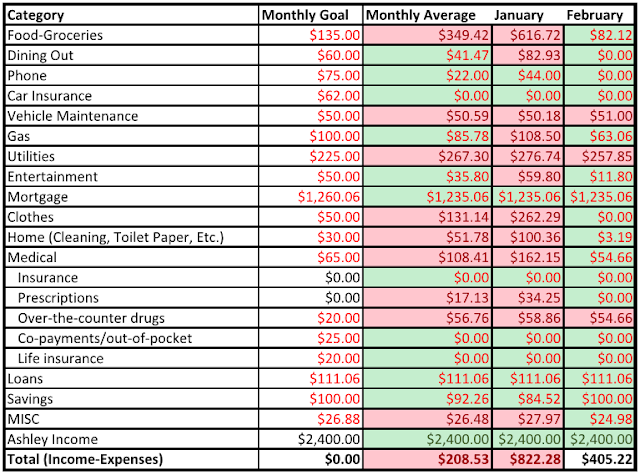

Thriftism's Monthly Budget - February Report

As we mentioned at the beginning of January, we are going to post monthly budget updates- So here we are! For a quick reminder, we run our budget off of solely my income of $1200 every two weeks, however this is after insurance is taken out. If this was your total household income, you would gross around $34,000/year and be in the 15% tax bracket. If you were in this tax bracket as a married couple, you would likely qualify for free or nearly free insurance so we won't need to up our budget in that area at this point. This budget also does not include much of our discretionary spending such as travel and home renovations, but it is our essentials budget that we could live on without anything else.

The Budget

The Budget

As you can see from the table above, our goal budget is balanced with total income minus expenses equal to zero. Number in red are spending, while black is income.

WINS ✔

If you compare this post to the one we did in January, you might notice we added two more columns - one for February, and one fore the Monthly Average. We did this to show how overspending some months can still even out for the year. I will repeat the warning that I did last time too though, DO NOT OVERSPEND IF THIS IS LEGITIMATELY ALL OF YOUR INCOME! We would not have purchased items from Sam's Club in January that we did not need if we were forced to charge it on a credit card. With that said, the monthly average shows how quickly our Sam's Club purchases are being balanced out.

We only spent about 60% of our grocery budget and none of our eating out money - thank you bulk purchases. Our average is still around $350 which is much too high, but with another month or two of low grocery bills, we should be right on track.

Our phone bill (you may have noticed that it says $0) is not a typo. We activated Race's phone last month and since the process took so long and they were having difficulties activating it, they comped us $90 which more than covers our $75 monthly bill. I'm willing to give up a few hours of my Friday for $90 that's for sure.

Car insurance is still zero since we haven't had to pay for this yet. We pay every 6 months, which is again why the average column comes in handy. If you have trouble cash flowing things like this, start saving the monthly amount either in a cash envelope or in a separate account. Gas was incredibly low as we haven't been driving as much and Race's expense income covers his fuel. If he were still at home, we'd be spending the same amount on fuel, which is why I've kept it as anything not covered by expense income.

We went under on entertainment. The only money we spent was on Netflix. Even though we hosted a dinner twice for friends and once for family, we didn't need to spend money. Since we ate in, we saved eating out costs and since we bought extra everything at Sam's Club in January, we didn't need things like groceries or wine.

Our mortgage looks like it is under, but out budgeted amount is the average of the bills. We are paying our current bill, but it will go up in May or June with new property taxes. This will likely show up as over budget for the second half of the year, but will average out.

We spent no money on clothing this month and only $3 on home supplies. Again, thank you bulk buying at Sam's Club. Our averages are still over, but they are quickly falling in line again.

Our medical category was under budget this month- yay for no serious illnesses, but we were still over on over the counter drugs as both of us had a lengthy cold at the beginning of the month. It worked out since we had no co-payments and haven't started a life insurance policy yet.

We paid the right amount for students loans. Fingers crossed, this bill will go away after next month as we will be paying off the remaining balance. We saved $100 out of my income - this generally will go towards our emergency fund or once that is funded to paying down student loans. Our miscellaneous spending was right around the budgeted amount too.

ROOM FOR IMPROVEMENT❌

Vehicle maintenance was slightly over as we renewed car tabs for $51.

Utilities were over again. We are still hoping that these will average out at the nicer weather approaches and the heating bill and space heater usage will both go down. If we are running over as we enter the second half of the year we will adjust.

Last thoughts...

With only three areas over budget, and technically only two since the medical category balanced out, I would say we did a fair job of following the budget. As you can see, we actually had over $400 left over. This helped to average out January's budget to only be $416 over budget. Can we erase this deficit by the end of March? We sure will try and be sure to check back in to make sure we follow through.

Side Note:

There has been a huge craze around having a no-spend month. This is buying only essentials for an entire month. We are not going to do a no-spend month, HOWEVER, we will be reporting weekly on everything we buy to show you that you can be incredibly frugal without feeling deprived. The no-spend challenge is a wonderful way to kick start your financial wellness journey, but may leave you with a less than happy mindset towards money. By changing you mindset from deprivation to finding ways to love you life living on less, you are sure to follow through and achieve your financial goals. Be sure to join us weekly on YouTube for our purchases updates.

Comments

Post a Comment