Thriftism's Monthly Budget - April Report

Happy May! With a new month rolling around, that means we need another budget update. For a quick reminder, we run our budget solely on my income of $2,400/month which gives us a gross income of $31,200. We do not include health insurance in our budget as ours is currently covered by our jobs, but if this was our household income we would also be taken care of by insurance subsidies. We do not include all discretionary spending such as traveling or major home renovations, but we do include all entertainment, grocery, dining out, and every day expenses. It is our essentials budget that we live on before adding in trips! If we can do it, so can you!

The Budget

Our goal budget is balanced with total income minus expenses equal to zero. Numbers in red are expenditures, while black is income. The green background indicates under budget. Red squares point out our overspending.

We did change up the budget a bit to reflect that the student loan is paid off. We split that amount between miscellaneous expenses and increased the savings goal.

WINS ✅

Our groceries and eating out were under budget! This helped bring out monthly averages down, but there is still progress to be made. Our monthly average is above the monthly budget due to our spending in January, but we're on the right track.

I still haven't been driving too much and since Race's work expense pay covers his fuel, we are way under budget here! Our mortgage was right on track and our home supplies was less than budgeted. This brought our monthly average below budget and balanced out our crazy January spending.

We didn't do much for entertainment in April, though I suppose some of our miscellaneous expenses should have been in entertainment (as we did have a game night that we bought supplies for). Clothing was also under budget.

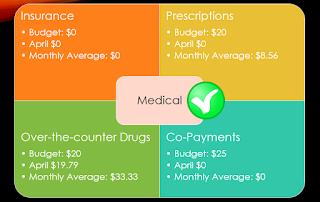

We also kept medical expenses down in April - no doctors, but allergies did start up.

Needs Work

Our phone expenses went over budget partially due to having to replace my phone screen and also due to a billing error from AT&T (extra $10).

We did have to pay car insurance this month, which is actually within the yearly budget, but obviously over the monthly budget. This will balance out by the end of the year. Paying for tabs for one of our vehicles put us over the $50 budget for vehicle maintenance, but we will be well within budget by the end of the year (monthly averages).

Utilities remained over budget, but hopefully with the heat that finally arrived at the end of April, our May utilities will be reduced.

Our miscellaneous spending was a bit out of control this month and we will work in May to reign that in. Due to this spending, we did not save as much as planned.

Last Thoughts

While we went over budget in a few areas, we were able to balance the budget by underspending in other areas. We also reduced our annual deficit to $80.12. With a few more months of underspending, we will be right on track! Be sure to check our the Thriftism YouTube Channel for spending updates and budget report videos!

Comments

Post a Comment