Thriftism's Monthly Budget - October Report

The Budget

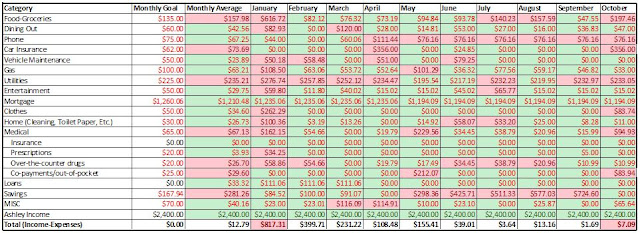

Our goal budget is balanced with total income minus expenses equal to zero. Numbers in red are expenditures, while black is income. The green background indicates under budget. Red squares point out our overspending.

We did change up the budget a bit to reflect that the student loan is paid off. We split that amount between miscellaneous expenses and increased the savings goal. We haven't adjusted other budget items, though as you'll see when you continue reading, we probably should have adjusted at least the phone and the utilities.

WINS ✅

We stayed well under budget on household supplies and kept up with the mortgage.

The only entertainment spending we had this month was Netflix. With Race working many weekends and working on the house the remaining days, we didn't have time to do too much. We did go over on clothing, but are still on track for the year.

We didn't have an maintenance this month and with me not working, I barely have to drive. This means fewer fill-ups and lower fuel costs.

NEEDS WORK ❌

Groceries were quite rough this month. We went way over the budget, but we expected this after such a low spending September. We are still over for the year and may not be able to make this up, but we will try to cut back in November.

We did have to pay car insurance this month. We pay semi-annually so two months of the year we will go over budget. The insurance did go up slightly with our car upgrade, but hopefully we will be close to budget by the end of the year.

We did have a few co-payments this month causing us to be over budget. Overall we are close to budget and should average out by the end of the year.

Savings was horrendous this month - we didn't save at all. We didn't have to pull from savings,but did know follow the budget well this month.

Our utilities have been high all year. Inflation is finally catching up to us. I have had the same utility budget for 5 years and with annual increase of up to 8% in all of our utilities we aren't able to keep it within this budget anymore. Plus, I no longer want to sit in a steamy or freezing house. We had high temps all summer (higher than average) followed by extremely low temps (we had snow in September 😢 ). This led to higher than expected utility costs.

Our phone bill went over again this month too and will continue to do so until the end of the year. I likely should re-budget to account for this, but our average will be under the annually budgeted amount, so it will be fine if we go over in the coming months.

LAST THOUGHTS

We did not have a good month as far as budget goes. We went over on six categories and barely met the budget this month. We will need to reduce spending in all categories to get back on track for the remainder of the year. We lost our focus in October, but will concentrate on staying under on our spending for the next month!

Be sure to check our the Thriftism YouTube Channel for spending updates and budget report videos!

Comments

Post a Comment